Call 0330 880 3600 Calls may be monitored or recorded. Opening Times.

- TRAVEL INSURANCE

- COVID-19 COVER

- More Options

- Help & Advice

- Existing Customers

Call 0330 880 3600 Calls may be monitored or recorded. Opening Times.

So let’s keep this simple: when you buy travel insurance, you’ll be sent a set of documents outlining the cover you’ve purchased. One of these documents will be your Policy Certificate, which has the basic details of the policy in relation to you, other travellers, and your trip details. This is where you’ll find your name(s), destination, travel dates, and any pre-existing medical conditions you might have needed to declare. You’ll also get a Policy Wording, which is usually the chunky, detailed booklet telling you all the terms, conditions, and exclusions of the policy you’ve bought. The Policy Wording is split into ‘sections’, which refer to specific things you are covered for. For example, Section A: Cancellation. These sections explain absolutely everything you can claim for, under the section heading. Bear in mind, your Policy Wording will also include something called ‘General Exclusions’, which is a list of things you absolutely would not be covered for under any circumstance - and they’re not negotiable. The easiest way to find information inside your policy documents, without reading the whole thing, is to open it on a computer and press CTRL and F on your keyboard. Type in the keyword you’re after, and 9 times out of 10, you’ll find what you need.

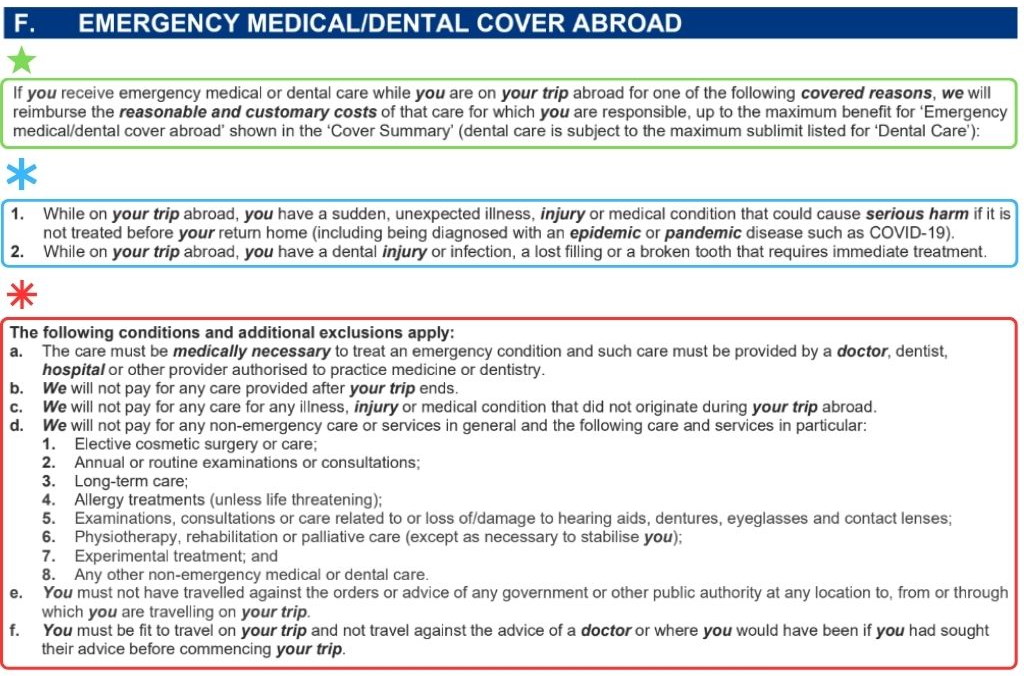

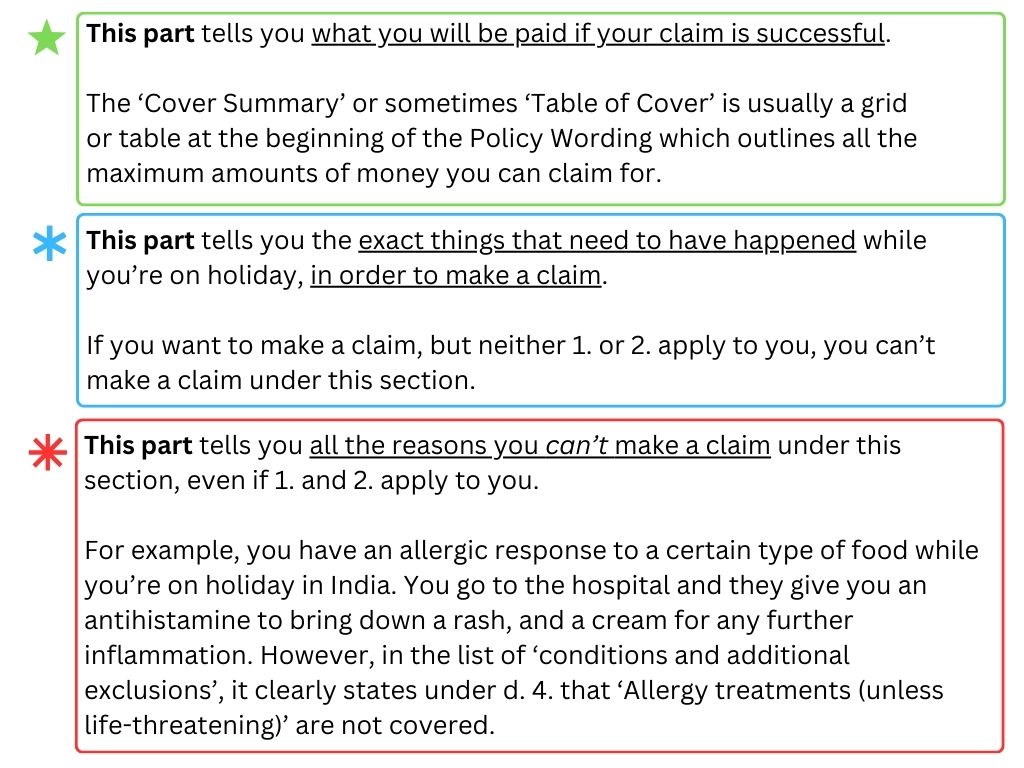

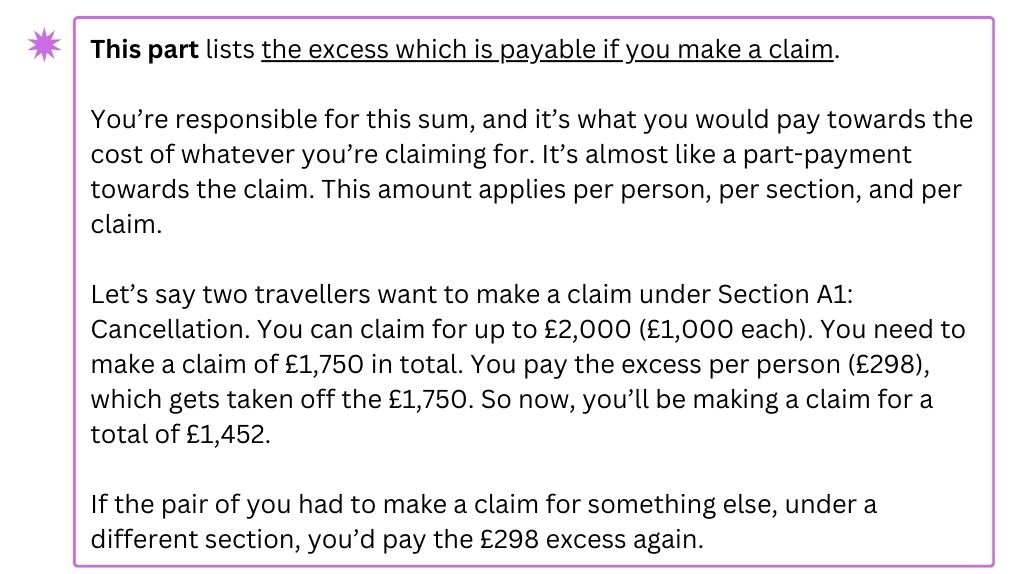

Now, the ‘sections’ themselves are a minefield. Each of them will tell you a) what you’re covered for, b) the specific circumstances you can make a claim for, and c) why you wouldn’t be able to make a claim under this section. If we take Section F: Emergency Medical Expenses* for example, it looks like this:

And that’s it really! The same general idea applies to each section. Sometimes there might be more exclusions, the list of covered reasons might be more/less specific, or (as we mentioned before) your situation might fit into this section, but be trumped by the General Exclusions. You might fracture your wrist one evening and need medication and surgery in hospital - however, you might also have had a few holiday drinks beforehand. Unfortunately, any claim arising from being intoxicated isn’t covered. That’s the kind of information you’ll find in the General Exclusions, so make sure you’ve familiarised yourself with those.

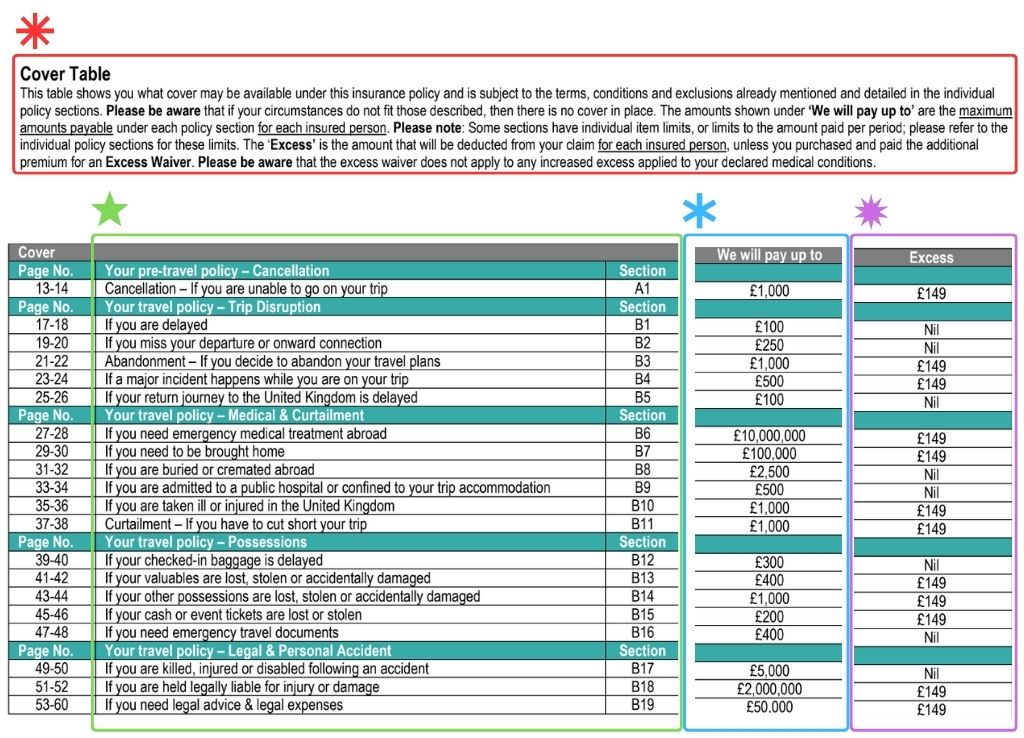

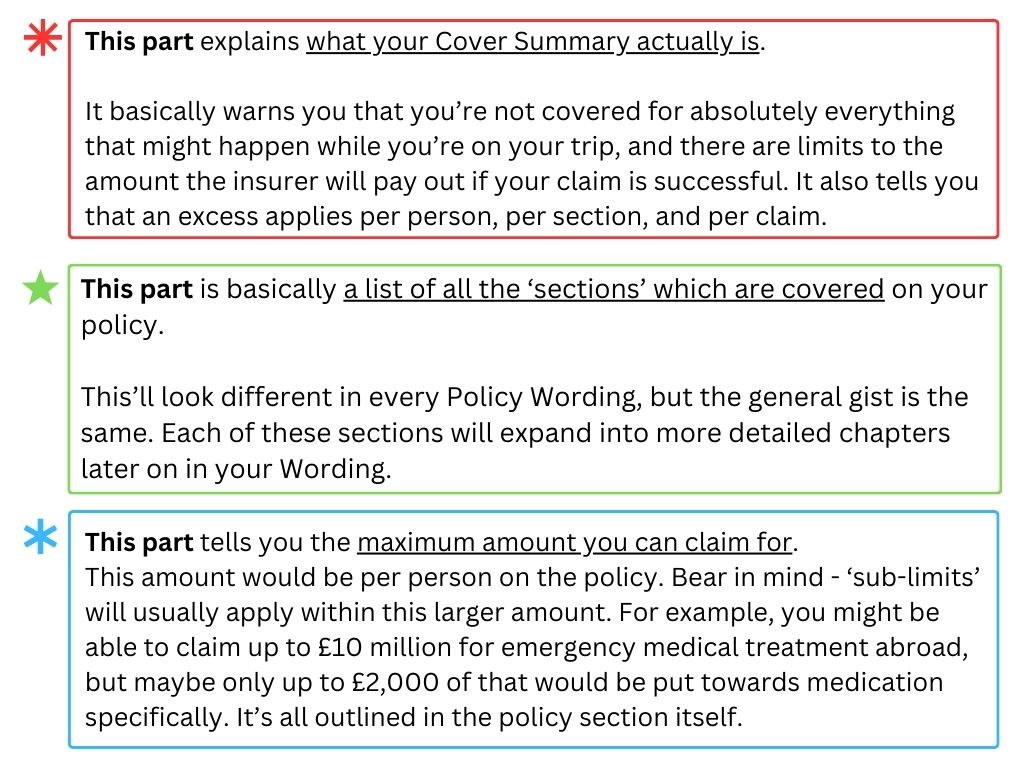

Now just quickly, because we mentioned it above, a ‘Cover Table’* or ‘Table of Summary’ can be broken down like this:

Once you’ve got a grasp on the Cover Table and how to read the sections of a Policy Wording, your documents should be much easier to read. And for any additional information, just give your travel insurance provider a quick ring - their customer care team will be happy to explain or confirm anything for you.

BY HOLLY GARWOOD, 30TH SEPTEMBER 2024